The earthquake that occurred in Sparta, North Carolina, has many people asking, “Do I need earthquake insurance?” Earthquakes are not just limited to the West Coast. They can happen in just about any state in the United States. So, should you consider getting earthquake insurance? What does it cover? What does it cost?

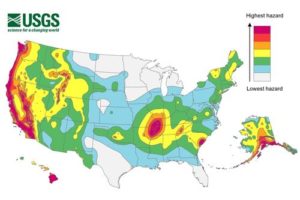

The South Carolina Department of Natural Resources (DNR) reports that earthquakes are a regular occurrence in the Palmetto State, with most occurring in the coastal plain. According to the U.S. Geological Survey, there are 42 states that are considered at-risk, as seen on the map below.

Why Should I Consider Earthquake Insurance?

While earthquake insurance is not required, this coverage can protect your home or office building if you sustain damage from an earthquake. As a rule of thumb, insurance is not designed to cover home maintenance issues or small claims. Insurance is about transferring risk to your insurance company, so that your assets are protected if a disaster occurs.

While most earthquakes in South Carolina are low-level quakes that produce minimal damage, even a small quake has been known to cause serious structural damage. This is particularly true for older homes and brick structures. If an earthquake damaged your home or place of business, would you be able to make the reparations needed?

If you aren’t sure that you could afford to repair or replace your home or office after an earthquake, then you may want to consider getting earthquake insurance.

What Do I Need to Know About Earthquake Insurance?

The first thing you need to know is that a standard homeowner’s policy does not cover earthquakes. Neither do policies for condominiums, dwelling fires, or renter’s insurance. Likewise, many business insurance policies do not offer earthquake insurance. If your car has comprehensive coverage, you may be compensated for damages sustained by your vehicle in an earthquake.

Earthquake insurance for your residence or business can be obtained through an endorsement or a separate earthquake policy. Lynn Hudson of The Turner Agency says to keep in mind three key points about earthquake insurance:

- Some earthquake policies may not cover the entire cost of rebuilding

- Some earthquake endorsements won’t cover damages to exterior masonry veneer (brick, stone, or manufactured stone)

- Decks and landscaping are generally not covered

When exploring your options for earthquake insurance, Hudson advises to be aware of the limitations above and to make sure the endorsement you are purchasing includes coverage for exterior masonry veneer if you need it.

What does Earthquake Insurance Cost?

The cost and amount of coverage for earthquake insurance varies. The cost of the policy will depend on several factors, including how much coverage you purchase and what materials were used to build your home or office building.

Deductibles for earthquake insurance are usually higher than a standard policy, usually ranging from 5% – 15% of the policy limit. Generally, you will find that the higher your deductible, the lower the premium.

How Do I Learn More about Earthquake Insurance?

The best way to understand your options for earthquake insurance is to contact us or your local agent. For a DNR South Carolina Earthquake guide, an earthquake hazard map of SC, and more, click here.

What to Do Before, During, and After an Earthquake

Prior to an Earthquake

To reduce damage inside, think heads up. Look at your ceiling and walls to see what might fall.

- Anchor bookcases and filing cabinets to walls.

- Secure ceiling lights, suspended ceilings, and other hanging items to the building structure.

- Anchor water heaters and large appliances to walls using safety cables or straps and lock the rollers of all appliances and furniture.

- Fit all gas appliances with flexible connections and breakaway gas shut-off devices or install a main gas shut-off device.

- Consider working with a registered design professional or licensed building contractor to reduce potential damage to the structure of your home or business.

- Add anchor bolts or steel plates between your home’s structure and foundation.

- Brace the inside of your home’s cripple wall with sheathing.

- Brace unreinforced chimneys, masonry, concrete walls, and foundations.

During an Earthquake

- If you are inside, stay there.

- Move away from windows, skylights, doors, and things that could fall.

- Duck, cover, and hold until the shaking stops.

- If you are outside, move quickly into the open, away from electrical lines, trees, and buildings.

- Drop to the ground and wait for the shaking to stop.

- If you are driving, slowly bring your vehicle to a stop at the side of the road.

- Do not stop on or under bridges, under power lines or near roadway signs.

- After the shaking has stopped, continue driving but watch out for damage to the road.

After an Earthquake

It is important to take some steps to protect yourself and your home from further damage after an earthquake.

- Clean up broken glass and remove debris.

- Board up broken windows and doors.

- Cover any roof damage with tarps or plywood.

- If possible, put damaged items in a safe, secure area where they can be inspected later.

- Save all receipts from any temporary repairs.

- Review your policy with your agent for detailed coverage explanations and to file a claim if you have experienced earthquake-related damage.

Choosing the right insurance agent is one of the most important decisions you will make. The Turner Agency, Inc. is a local Trusted Choice® independent insurance agency located in Greenville, South Carolina. Serving the Upstate of South Carolina and beyond since 1962, we offer a variety of personal and business coverage choices and can customize an insurance plan to meet your specialized needs for your business, homes, automobiles, recreational vehicles, secondary homes, and more. Contact The Turner Agency today.

The information in this article was obtained from various sources, including Trusted Choice, SCDNR, Safeco Insurance, and the US Geological Society, and is not all inclusive regarding the subject matter. This content is offered for educational purposes only.