We hear the question, “Why are my insurance rates going up?” every day. Believe us when we say that we understand your frustrations. In fact, we addressed this very topic a few months ago in this article.

On the homeowner’s insurance side, the cost to repair and rebuild homes continues to go up. The price of building materials (lumber, concrete, sheet rock, asphalt, etc.) remains on the rise and shows no signs of dropping. The lack of workers in the construction industry also remains a problem. (There were over 420,000 job openings reported, just in construction business, at the end of September 2022.)

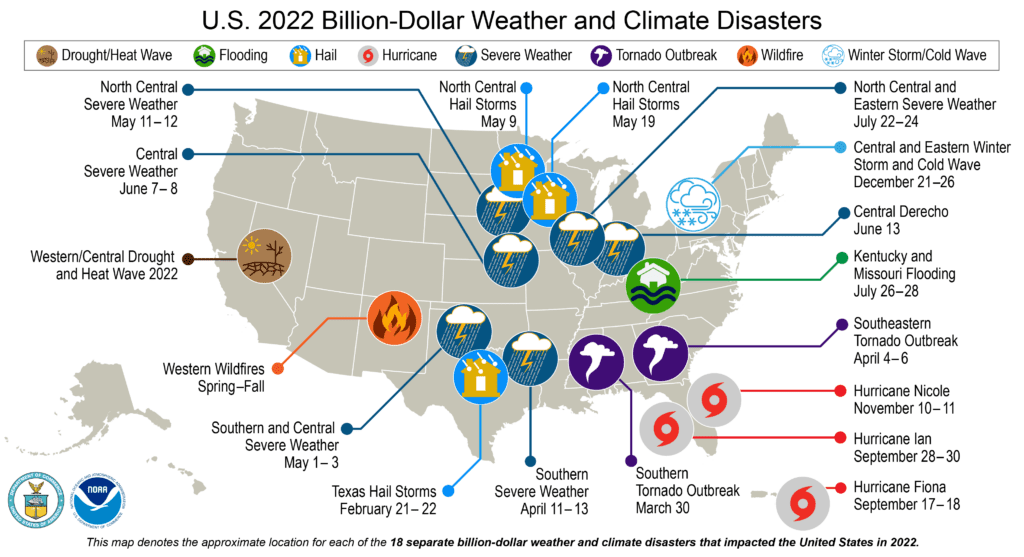

Last year, the United States experienced 18 separate weather or climate disasters that each resulted in at least $1 billion in damages (see the image below for the breakdown). The largest losses were due to flooding in Mississippi and Kentucky, tornadoes that spread across the Southern United States, and Hurricanes Nicole, Ian, and Fiona. While we may not have been directly affected by these, the insurance companies we represent were.

These weather conditions also affected loss rates in the auto industry, while new and used car prices are still going up. If you have shopped for a car recently – you know how little inventory is out there. Supply chain issues have triggered a shortage of cars, along with a shortage of computer chips. Repair work is up 15% from this time last year, and the labor shortage has also affected the auto industry.

So what can you do to offset the increases? Here are our suggestions:

Consider increasing your deductibles and liability limits. If you can manage out-of-pocket costs being a little higher in the event of a claim, your annual premium will decrease. Some companies also offer discounts for carrying higher limits of liability.

Is all of your insurance coverage with The Turner Agency? Not only does this benefit you and help eliminate possible coverage gaps, we may be able to offer you a multi-policy discount.

Are your children eligible for good student and good driver discounts? If they have an average of 3.0 or better, make sure we have a copy of their transcript. Also, if they are away at college without a car, you may be eligible for a discount.

Are you open to telematics? Safe driving can lead to savings. Several of our partners offer discounts of up to 30% on your auto rates based upon the driving behavior of those on your policy. These driving behaviors are measured by technology. Some companies offer a trial period where you can opt out before it affects your rate. If you are a good driver, letting the company track your driving might be worth considering.

Ask us about payment options. Monthly plans may incur fees, so paying in full may save you money.

Call us before filing a claim. If you think you need to file a claim, let us help you determine the best way to proceed. If your deductible is $1,000 and the claim is estimated at $1,200, you may be better off to pay it out of pocket. We are happy to talk through the options with you.

Don’t move your coverage every year. Several companies offer loyalty discounts after you are with them for a period of time. In addition, the length of time you maintain continuous coverage with the same insurance company is often used as a rating factor on a new policy.

Take care of maintenance issues before they become major problems. Rotate your tires and have your car serviced regularly. Clean out your gutters, have annual termite inspections, trim overhanging limbs or dead branches, etc., to prevent major damage down the road.

Pay your bills on time. Believe it or not, this is a factor in determining your insurance premium. People who have a good credit score are considered to be better risks and therefore receive more favorable rates and sometimes a “good payer” discount.

At the heart of it all, insurance is about protecting you against risk. We appreciate your trust in us and we will continue to deliver real protection, offer risk management, advise, and advocate for you.